Table of Content

- The Brewmaster’s Table: Discovering the Pleasures of Real Beer With Real Food

- The BuckRye State | Ohio Craft Beer Signs | Beer Map, Bonus Room, Game Room, Wall Art, Wall Decor, Bar Decor, Man Cave

- Pizza and Beer Shirt | Mens Valentines Gift | Gifts for Dad | Gifts for Husband | Funny Pizza TShirt

- NewAir Beverage Refrigerator Cooler

- Crowns & Hops Brewing Co. Black People Love Beer Crewneck Sweater

- Arra David and Anne Johnson Beer Chilling Coasters

The neoprene beer carrier keeps 6 beers chilled and secure and comes with a bottle opener so that no matter where the Christmas party happens, the beers are taken care of. You can add whatever snacks or chocolates the person likes to make this gift basket more exciting. Or, you can add beer accessories such as beer openers and coasters.

In-house beer experts scour the country for the best beer and also consider top beer ranking sites like Rate Beer and Beer Advocate. CraftBeer.com has an extensive list of the many beer styles available. Check this DIY craft beer gift basket blog post by Chasing daisies to find out what are the appropriate items that are to be included in a beer gift basket. If you’re still struggling, follow the exact DIY to create a super simple craft beer basket. Are you struggling to try to find a gift you can present to your groomsmen?

The Brewmaster’s Table: Discovering the Pleasures of Real Beer With Real Food

If you know they love a malty dark lager and some spicy peanuts, try gifting them. Fill up this box with two beers, two snacks, the remote, and your phone, and you won't have to leave the couch while you watch the game. This lightweight box comes equipped with carrying handles and cutouts for a pair of bottles or cans, a pair of included plastic snack bowls, and slots for a phone, remote, or napkins.

From casual sippers to serious enthusiasts, this book is aimed at educating beer drinkers of all levels. This table for two conveniently digs into any soft ground and holds two cans and a snack bowl—perfect for beach trips, bonfires or backyard hangs. The handmade Baltic birch and stainless steel table disassembles for easy transportation. Best of all, a built-in beer opener lets you crack bottles wherever you please. These DIY beer openers are awesome gifts for the man in your life. But if you give them a piece of wood and some other things, they would be the happiest person in the world.

The BuckRye State | Ohio Craft Beer Signs | Beer Map, Bonus Room, Game Room, Wall Art, Wall Decor, Bar Decor, Man Cave

We can help you gift the wine-snob, your mother-in-law , and even your coworkers. Ahead, you can find 37 beer-inspired gifts, from some high-tech keg gadgetry to cool brewery collaborations to home décor that'll help them kick back and enjoy that beer all the more. The shipment also includes a newsletter detailing who made the beers and how, as well as an interview with the owner and/or brewmaster. Plus, Craft Beer Club throws in a one-year subscription to Beer Connoisseur, custom koozies and a beer opener for free. Choose from a monthly, every-other-month or quarterly subscription.

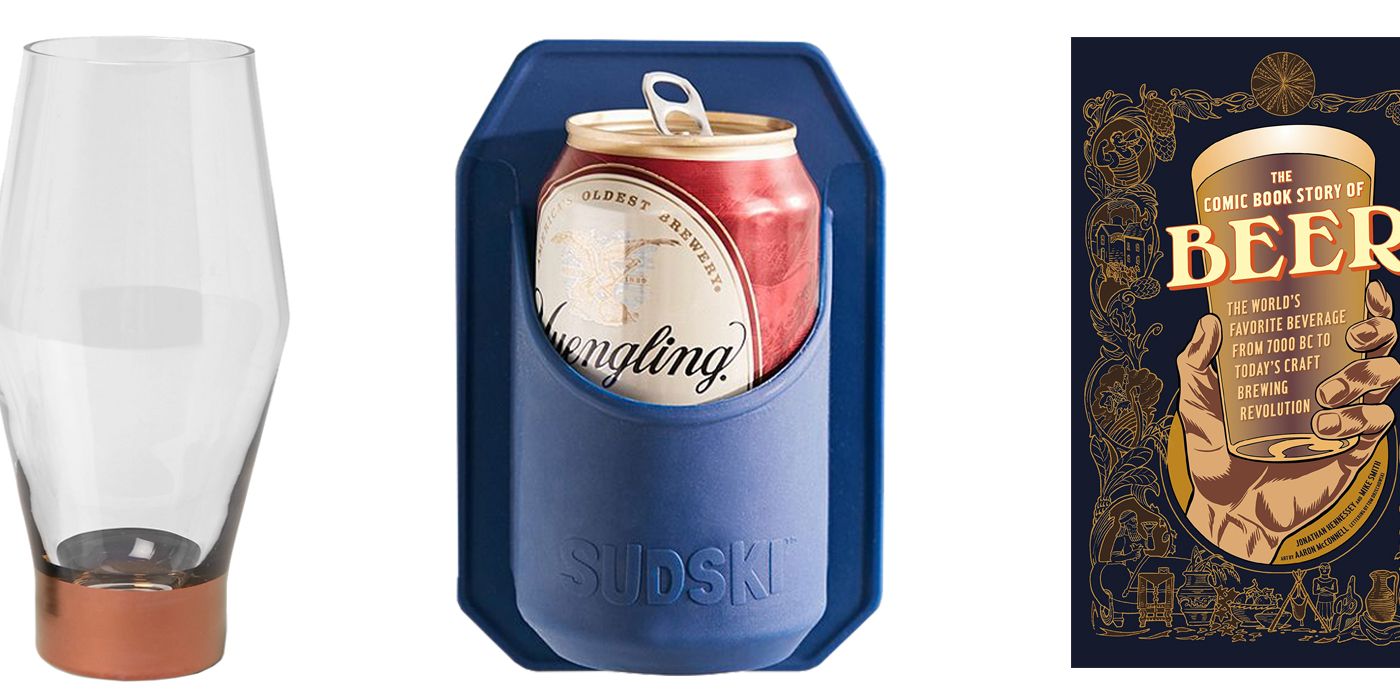

There are four glasses per order—perfect for happy hour with friends. It’s an ideal glass to have as your house option—it holds a generous 14 ounces, is lightweight, and is dishwasher safe for speedy cleanups. This one is far more complex than the standard foam koozie. Made with double-walled stainless steel and a copper layer finish, the BrüMate Hopsulator cooler securely holds both 12- and 16-ounce cans and keeps them chilled for hours. Whether they're an obsessive home brewer, curate their own basement bar, or would just appreciate a custom craft, here's a unique way to liven up their space that truly taps into their interests. Whether it’s a beach party, a camping trip, or any other outdoor outing where alcohol is involved, transporting a collection of cans can be a pain for whoever’s in charge of supplying the suds.

Pizza and Beer Shirt | Mens Valentines Gift | Gifts for Dad | Gifts for Husband | Funny Pizza TShirt

One package of these classic confections has about 60 individually-wrapped pieces, but we’re sure they’ll eat their way through it in no time. Tired of having a kitchen floor or bar area littered with bottle caps? Consider the Kovot Magnetic Bottle Opener to be your official gateway to enjoying a beer while barefoot.

The shelves are also fully adjustable to accommodate bottles and oversize containers, plus snacks. It's a great way to turn a beer lover's basement, backyard or garage into a luxurious private bar. The compact appliance has seven different automatic temperature settings for everything from cellaring bottles of wine or beer to keeping cans of soda ice-cold. When you think about the different types of beer, pilsners, lagers, and ales probably come to mind, but don’t forget about the sweetest beer of all—root beer!

Best for History Buffs: A History of the World in 6 Glasses by Tom Standage

We know Santa's elves do fine work, but the brewers featured in the Craft Beer Club rival their quality and attention to detail and the club delivers every month. Share this list with friends and family and make their shopping a breeze. Every beer drinker knows that once a beer has been sitting out for awhile, it loses its initial distinct aroma. You won’t have that problem any longer after you put your beer on this booster, push the button and watch it do its magic. For when you’ve bought a mini keg and want to keep it cold, put it into this mini fridge and you’ll be the life of the party. This is the perfect way to make your apartment look more festive.

All you have to do is slide your can into this condensation-free cooler, at which point it’ll remain locked into place until you unscrew the gasket to replenish your supply. His personal favorite is this Hydro Flask option, a BPA- and phthalate-free growler with TempShield insulation that keeps beer chilled all day. Plus, a leak-proof seal with two interior threads keeps beers carbonated longer than most growler systems. Pop the growler in the dishwasher, or "clean with soapy water and a bottle brush," adds Fuller.

There’s two compartments—one for smaller items in the front, and a larger insulated, leak-resistant beverage compartment. “There is nothing worse than your beer getting hot,” says Brad Bierman, taproom manager of JDub’s Brewing Company. For warm-weather drinkers, he recommends this Tervis tumbler. Its durable, double-wall insulation keeps hot drinks warm and cold drinks chilled. The 24-ounce tumbler also cleans with ease and is microwave-, freezer- and dishwasher-safe. All in all, Standage does an excellent job of weaving in historical facts with spirited storytelling, making this a must-read for every drinker.

For slightly more advanced homebrewers, this stylish brewing kit comes with the recipe, ingredients, and equipment for one gallon of single hop IPA. This beer jelly has the classic sweetness of a jam while also incorporating the traditional ingredients of beer. This 8-pack of coasters contains different humorous quotes relating to beer, keeping you entertained even when you put the bottle down. For those times when you don’t have an ice bucket with you to keep your beer cool, stick one of these chiller sticks in your beer to keep it cold.

Get inspired to create a special gift for Dad by checking out our step-by-step guide; it will surely be your favorite DIY piece. It can be a daunting task if you are crafting for a beer lover and don't know where to start. You can still find unique and thoughtful gifts for the beer enthusiast who has everything or the person who is already super particular about the craft beers they drink. All you have to do is apply some of your creativity and DIY spirit!

Nothing compliments a cold one better than a tasty plate of food. This cookbook by John Hall captures the flavors from the best brewery and brewpub menus. There are 155 different recipes for all meal types, including vegetarian and gluten-free options if your beer lover has a more restrictive diet. Delaware-based brewery Dogfish Head has gone from cult favorite to a virtually universally-beloved brand among craft beer fans, thanks to their tasty IPAs. Get them this collab with Igloo Coolers to help them carry those chilled cans in style.

Crowns & Hops Brewing Co. Black People Love Beer Crewneck Sweater

IPAs are more citrusy, lagers more crisp, and porters more roasty-toasty. These comfy flip-flops are great for the beach, but what are they doing in this story? There's a secret bottle opener built into the sole so you can crack into a cold one anywhere. A thicker instep and heel- and arch-supporting shape make room for the opener without interfering with walking, which makes these both useful and more comfortable than cheap plastic flip-flops.

Available in either oak or walnut finish, the coasters are handmade in Leicestershire, England. As with baking sourdough, home brewing has seen a resurgence lately. “The good people at Brooklyn Brew Shop have the perfect set-up for the novice enthusiast,” says Shaun O’Sullivan, the brewmaster and a founder of 21st Amendment Brewery. Its one-gallon kits include almost everything you need for your first batch of home brew, along with step-by-step instructions with links to video guides. They can fill it with their favorite craft beer bottle tops. Anyone who says beer can’t be art has clearly never seen the glory that is this Personalized Beer Cap Shadow Box from Southern California Etsy seller Engraved Memories Etc.